Passing the Torch: Family Succession in a Real Estate Investment Firm

- Sep 30, 2025

- 12 min read

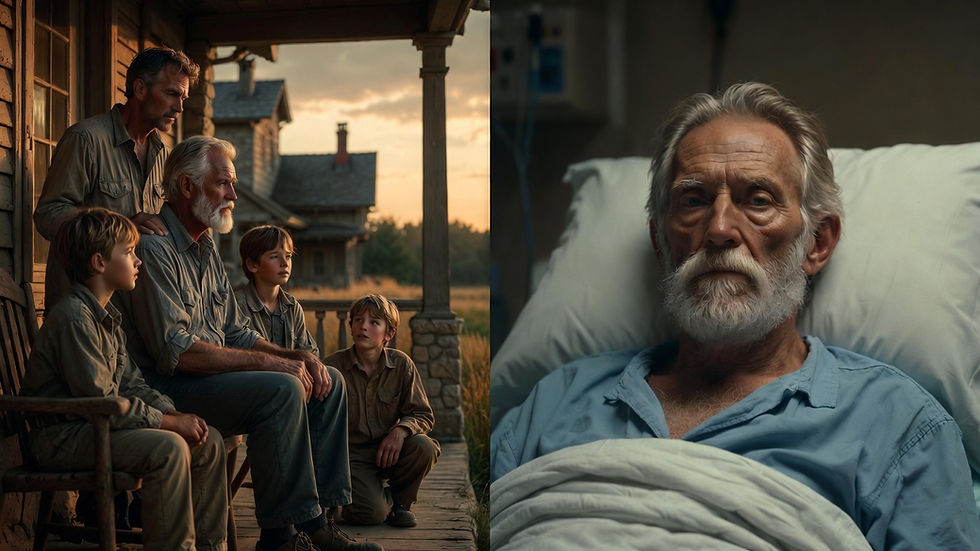

How to Prepare Your Firm, Your Family, and Your Legacy for a Seamless Transition

Real estate is one of the most powerful vehicles for building generational wealth. Properties endure. Portfolios compound. Deals made today often outlive the people who made them. And yet, despite this inherently generational nature, too many real estate investment firm owners overlook one critical question:

“What happens to the firm—and the family—when I’m no longer here to lead?”

This is where the dream of building a family-run real estate empire collides with reality. We’ve seen it countless times: brothers who can’t agree on strategy, heirs who inherit properties but not the wisdom to manage them, tax burdens that force the sale of treasured assets, and founders who delay succession so long that decisions are made in crisis rather than with clarity.

The truth is, real estate succession isn’t just about titles and ownership percentages. It’s about preparing your heirs to lead, protecting the value of the portfolio, and creating governance structures that outlast any single person. It’s about turning hard-earned properties into a family enterprise that thrives across generations instead of crumbling under conflict.

At Dominion Business Advisors, we don’t just understand family business, we understand family business in real estate. We know how assets, entities, and partnerships interact. We know how family dynamics can either compound or erode wealth. And we know the practical steps it takes to prepare your portfolio, your family, and your legacy for a seamless transition.

Because at the end of the day, succession isn’t just a financial event. It’s a relational, cultural, and spiritual one. And the families who approach it with intentionality will see their firms prosper...not just for one generation, but for many to come.

1. Why Family Succession Matters More in Real Estate

Most businesses face succession challenges, but real estate firms are unique. Unlike companies where the product changes with each cycle, real estate portfolios tend to outlive their founders. Properties appreciate, rental income compounds, and investment structures can endure for decades. That longevity makes real estate a natural candidate for family succession, but it also makes the stakes higher.

Without a clear plan, what should be a blessing can quickly become a burden. We’ve seen families torn apart over questions like:

Who will manage the properties after the founder steps aside?

How are distributions to be handled? Equally, or based on effort and involvement?

What happens when one sibling wants to reinvest profits while another wants cash out?

How will taxes and estate obligations be covered without forcing a fire sale of assets?

These questions aren’t hypothetical, they’re real-world issues that derail families every year. A portfolio that took decades to build can fracture in months when succession isn’t addressed.

This is why family succession in real estate matters more than in most other industries. You’re not just handing off an operating company, you’re transferring hard assets, ongoing income streams, and a long-term vision for growth. That requires far more than just updating ownership documents. It requires governance, preparation, and a unified family strategy.

At Dominion Business Advisors, we guide owners through this process every year. We understand both sides of the equation: the financial structures that protect assets and minimize taxes, and the family dynamics that determine whether those assets remain a blessing or become a source of division.

Because in real estate, succession isn’t optional, it’s inevitable. The only question is whether you prepare for it intentionally, or leave it to chance.

2. The Hidden Risks of Avoiding Succession Planning

Many real estate investment firm owners delay succession planning because it feels complicated, or because the business is running well today. But avoiding the issue doesn’t make the risks go away. It simply magnifies them.

Here are the dangers we see most often when family succession is left unaddressed:

Family Disputes: Without clear governance, heirs end up in conflict. One sibling may push for selling properties, while another insists on holding long-term. Disagreements about distributions, management roles, and decision-making authority can fracture both the business and the family.

Forced Sales: Estate taxes, debt obligations, or liquidity needs often catch families off guard. Without proper planning, heirs may be forced to liquidate prime assets (sometimes at below-market prices) just to cover obligations.

Leadership Vacuums: If heirs aren’t prepared or willing to step into management, the firm can quickly lose value. Properties may be mismanaged, deals missed, and trusted employees may leave in uncertainty.

Lost Opportunities: In real estate, timing matters. A portfolio without clear decision-makers can’t act quickly. While families debate, deals vanish, financing windows close, and competitors gain ground.

Emotional Toll: For founders, failing to plan often leaves a legacy of chaos instead of clarity. For heirs, it can turn what should be a generational blessing into a generational burden.

The harsh truth is that most of these risks are entirely preventable. With the right structures like buy-sell agreements, estate planning tools, governance boards, and succession frameworks, you can reduce conflict, protect value, and ensure continuity.

At Dominion Business Advisors, we’ve seen both sides: families who avoided planning and paid the price, and families who embraced succession and preserved their wealth for generations. The difference comes down to intentional preparation.

Succession doesn’t just protect assets, it protects relationships. And for most owners, that’s the real legacy they want to leave.

3. Building the Next Generation of Leaders

Real estate portfolios can be passed down with signatures on legal documents. But leadership? That can’t be transferred with a pen. If the next generation isn’t equipped to manage assets, people, and strategy, the portfolio you built will slowly unravel.

This is where many families stumble. The founder assumes heirs will “figure it out,” or heirs assume they’ll automatically inherit both the wealth and the wisdom. The result? A leadership gap that weakens the firm and invites conflict.

Strong succession requires more than ownership, it requires leadership development.

Here’s what that looks like in practice:

Identify strengths early. Not every heir is wired for asset management or negotiations. Some may excel at finance and reporting, others at operations or investor relations. Clarify who’s gifted to lead, who’s better suited to support, and where professional managers may need to fill the gaps.

Create pathways, not entitlements. Leadership in a real estate firm should be earned, not assumed. This means internships, shadowing senior managers, and gradually taking on responsibility before inheriting authority.

Invest in education and mentoring. Expose heirs to financial modeling, deal structuring, property management, and the legal/tax landscape. Pair them with outside advisors who can broaden their perspective.

Give them a seat at the table. Involve the next generation in decision-making now. Let them participate in strategy sessions, board meetings, and investor updates, not just observe from the sidelines.

At Dominion Business Advisors, we often tell families: “If you wait until the founder is gone to test leadership, it’s already too late.”

For Christian business owners, this process is discipleship as much as development. You’re not just training successors, you’re raising stewards who will carry both assets and values forward.

A portfolio without prepared heirs is like a building without a foundation: it might look strong, but the cracks will show under pressure. A family enterprise with trained, empowered leaders, however, becomes a fortress that can stand for generations.

4. Governance Structures That Protect the Family and the Firm

A real estate portfolio may be held in LLCs, partnerships, or trusts, but without governance, those structures are just legal shells. True family enterprises thrive on clear rules, transparent processes, and accountability. Without them, even the most valuable portfolio can collapse under the weight of family conflict.

Governance is what transforms a collection of assets into a sustainable enterprise. It ensures that decisions aren’t made based on emotion, power struggles, or whoever speaks the loudest, but on agreed-upon principles that protect both the family and the firm.

Here are the cornerstones of strong governance in a family-owned real estate firm:

Family Constitution or Charter: A document that outlines mission, values, and rules for decision-making, ownership transfer, and succession. This keeps everyone aligned on the “why” and “how” of the enterprise.

Operating Agreements & Buy-Sell Provisions: Clear legal agreements that dictate what happens when an owner dies, retires, divorces, or wants to exit. Without these, families are often forced to sell prime assets to resolve disputes.

Advisory Boards or Independent Trustees: Bringing in outside advisors adds objectivity and professional expertise, especially in real estate markets that shift quickly. They help balance family interests with business realities.

Defined Employment Policies: Establish rules for when and how family members can join the business. Equal opportunity doesn’t always mean equal roles. Setting standards protects credibility with employees, investors, and partners.

Conflict-Resolution Mechanisms: Disagreements are inevitable. Having a formal process for mediation, arbitration, or outside facilitation prevents small issues from escalating into lawsuits, or family estrangement.

At Dominion Business Advisors, we’ve seen governance act as the guardrail that keeps families from driving their firms off the cliff. Without it, what begins as a disagreement about distributions can escalate into fractured relationships and lost properties. With it, families navigate transitions with clarity and unity.

Governance may feel restrictive at first, but it actually creates freedom, the freedom for family members to stay connected without every holiday meal turning into a boardroom battle.

Because in real estate, assets can last a lifetime, but without governance, family unity often doesn’t.

5. Financial & Tax Planning for Succession

When it comes to real estate, succession is not just an emotional challenge, it’s a financial one. Properties are valuable, illiquid, and often complex to transfer. Without careful planning, your heirs may inherit not only buildings and income streams but also tax burdens, debt obligations, and liquidity crises.

This is where many families stumble. A founder assumes the portfolio will “just pass on,” but in reality, estate taxes, capital gains, and legal costs can erode millions of dollars if not planned for in advance. The tragedy? Families often end up selling prime properties (sometimes at fire-sale prices) just to cover obligations.

Here’s how proactive financial and tax planning protects both wealth and legacy:

Transition Strategies: Decide whether ownership will be passed through gifting, trusts, staged transfers, or outright sale. Each path has very different implications for taxes and control.

Estate & Gift Tax Mitigation: Explore tools such as family limited partnerships, grantor trusts, and charitable strategies to minimize exposure. Real estate offers unique planning opportunities that most families overlook.

Liquidity Planning: Even profitable portfolios can be “asset-rich, cash-poor.” Build liquidity reserves, consider life insurance solutions, or create structured buyout mechanisms to avoid forced sales.

Debt Structuring: Refinance strategically before transition to ensure debt loads are sustainable for heirs. Buyers and successors alike want to see leverage that is manageable, not crippling.

Professional Teamwork: This isn’t a DIY project. It requires coordination between CPAs, estate attorneys, and strategic advisors who understand both family business dynamics and real estate markets.

At Dominion Business Advisors, we help families map not only the emotional and operational side of succession but also the financial mechanics that make the transition possible. We’ve seen families save millions, and preserve entire portfolios, simply by acting early and planning wisely.

Because in real estate, the question isn’t whether taxes and costs will come due. It’s whether you’ll prepare in advance, or leave your heirs scrambling to pay the bill.

6. Preserving Culture and Legacy in a Real Estate Firm

Buildings can be bought and sold. Portfolios can change hands. But culture—how your family does business, how you treat tenants, how you view stewardship—is what truly endures. Without intentional effort, though, culture and values often die with the founder.

This is where many families underestimate succession. They focus on ownership and taxes, but overlook the “softer” elements that actually hold the enterprise together. The truth is, without cultural continuity, heirs may inherit properties but lose the very ethos that made the firm successful.

Here’s how to preserve your firm’s culture and legacy:

Codify Core Values. Write down the principles that guide your family’s investment philosophy. Is it long-term stewardship? Community development? Conservative debt use? Document them so future leaders know the “why” behind every decision.

Tell the Story. Real estate firms thrive on legacy narratives, how the first building was acquired, the sacrifices made, the vision behind growth. Share these stories with the next generation so they feel like heirs to a mission, not just recipients of assets.

Embed Values in Decisions. Culture isn’t abstract. It shows up in how you treat employees, negotiate deals, or maintain properties. Make sure governance documents, policies, and even investment criteria reflect your family’s convictions.

Align Wealth With Purpose. Consider how philanthropy, community involvement, or faith-driven goals tie into the business. A portfolio can generate more than profits—it can fund ministry, build communities, and serve as a testimony of stewardship.

At Dominion Business Advisors, we often tell clients: “Legacy isn’t just what you leave behind—it’s how you leave it.” If heirs receive assets without values, the enterprise rarely survives the second or third generation. But if they inherit a culture of stewardship, the portfolio becomes a platform for generational impact.

Because in the end, succession isn’t just about real estate. It’s about raising a family that sees themselves not merely as owners, but as stewards of something greater than themselves.

7. When Family Isn’t the Best Successor

Every founder dreams of passing the business to the next generation. But sometimes, the best path isn’t keeping management in the family. And that’s okay.

The reality is that not every heir is called (or equipped) to run a real estate investment firm. Some may lack the interest. Others may not have the skills or temperament. Forcing them into leadership roles they aren’t suited for doesn’t honor them, the business, or your legacy.

Here are alternatives that protect both the portfolio and the family:

Professional Management: Families can retain ownership while hiring experienced executives to run operations. This model preserves wealth while ensuring the firm is professionally managed.

Management Buyouts: Loyal employees or leadership teams can purchase the firm gradually, often preserving culture and continuity better than an external sale.

Strategic or Partial Sales: Selling all or part of the portfolio to institutional investors can provide liquidity while keeping family ownership in select assets.

Blended Models: Some families keep voting control while delegating operations to non-family managers. Others combine family board oversight with professional management.

The key is honesty. Ask yourself:

Do my heirs have the desire to lead, or just the expectation to inherit?

Would forcing them into roles create resentment, burnout, or conflict?

How can I design a structure that allows them to benefit from ownership without being burdened by responsibilities they can’t fulfill?

At Dominion Business Advisors, we help families wrestle with these tough questions. We know that preserving a legacy doesn’t always mean keeping the same people in the same roles, it means ensuring the firm thrives for generations, whether or not family members are in day-to-day leadership.

Sometimes, the most faithful act of stewardship is recognizing when succession means ownership, not management. And designing a structure that honors both the family and the business.

From Property Focused to Next Generation Focused

Real estate is unique because it was never meant to be short-term. Properties outlast people. Portfolios outlive careers. The real question isn’t whether your firm will survive you, it’s whether it will thrive because of you.

Without succession planning, even the strongest portfolio can unravel into conflict, taxes, or forced sales. With intentional planning, however, your firm becomes more than a collection of assets. It becomes a family enterprise, a structure that preserves wealth, strengthens unity, and carries your values forward.

Family succession in real estate requires more than legal documents. It demands trained leaders, clear governance, financial foresight, and cultural continuity. Done well, it transforms your life’s work into a generational blessing rather than a generational burden.

At Dominion Business Advisors, we specialize in helping real estate families make that transformation. We understand the complexity of tax and entity structures, the weight of family dynamics, and the responsibility of leaving a legacy worth inheriting.

The question is not whether your family will inherit your assets. The question is whether they’ll inherit a thriving enterprise or a fractured estate. The difference is made in the decisions you take now.

So don’t wait until illness, conflict, or the IRS forces the conversation. Begin today while you still have the clarity, influence, and time to prepare.

Because your properties are valuable. But your legacy? That’s priceless.

Let’s Connect

If you’ve been feeling the weight of unanswered questions: "Who will lead? How will assets be divided? Will taxes or conflict undo what I’ve built?", then now is the time to act.

Imagine walking into your office knowing your children are prepared, your governance is clear, and your real estate portfolio is structured to endure for decades.

Imagine your heirs stepping into leadership with confidence, supported by systems, advisors, and agreements that protect both family unity and portfolio value.

Imagine knowing that when you transition out, the properties you’ve acquired won’t be liquidated in chaos, but will continue to generate income, security, and opportunity for generations to come.

That is what intentional family succession creates.

And you don’t have to figure it out alone.

Schedule Your Free Exit Readiness Consultation Today

At Dominion Business Advisors, we help business owners like you build businesses that bless beyond the bottom line. Together, we’ll walk through where you are today, where you want to go, and what it takes to get there, so you can exit your business on your terms and leave a legacy that lasts.

Final Encouragement

Remember, you were never meant to do this alone. Let us walk alongside you in building a plan that brings clarity, confidence, and legacy for the next season of your life and leadership.

*Dominion Business Advisors LLC provides strategic business consulting and exit planning services. We do not provide legal, tax, or investment advice. Information in this article is for educational purposes only and should not be construed as specific advice for your situation. Please consult your attorney, CPA, and financial advisor before implementing any exit planning strategies.

.png)