Not All Exits Are Created Equal: A Father's Guide to the Business Transitions That Build or Destroy Legacy

- 18 hours ago

- 11 min read

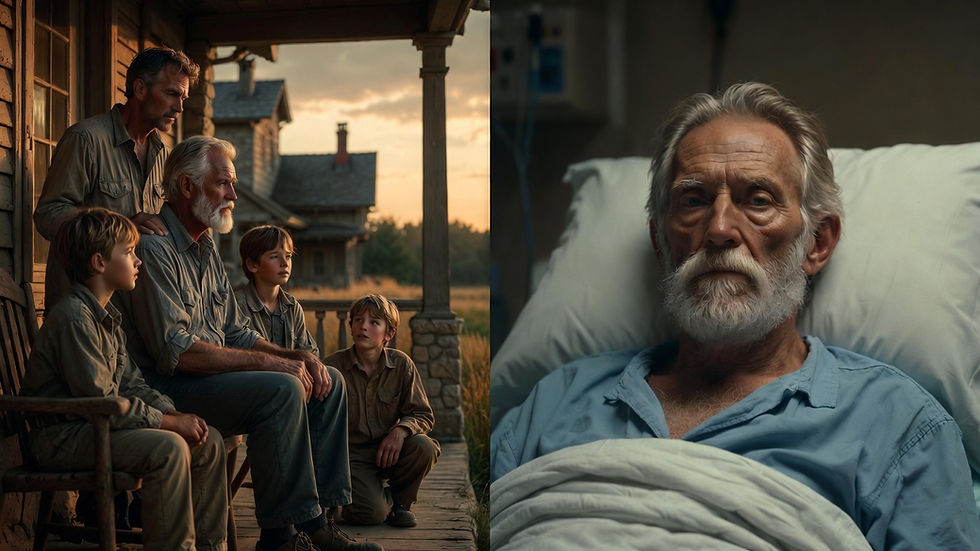

Christian Business Exit Planning

Most Christian business owners will tell you they plan to "sell the business someday." Press them a little harder and you find out they have no idea what that actually means. They picture one thing: a buyer writes a check, they hand over the keys, and life continues somewhere on a lake with a fishing rod.

That is not how any of this works. And the men who walk into the most consequential financial transaction of their lives with that level of ignorance are the same men who walk out of it with shattered families, gutted legacies, and a pile of regret that no amount of lake frontage can fix.

There are at least half a dozen fundamentally different ways to transition a business. Each one carries different implications for your taxes, your family, your employees, your church, your community, and the multi-generational vision God has called you to steward. A patriarch who does not understand these options is like a general who does not understand the terrain. He will lose the battle before it starts.

Let me walk you through the landscape.

The Third-Party Sale: Clean Break, Costly Consequences

This is what most men picture. A strategic buyer or financial buyer (usually a private equity firm) acquires your company. You negotiate a price, endure due diligence, sign the papers, and walk away.

The upside is straightforward. You receive the highest possible valuation in most cases, especially if your business has strong recurring revenue, clean financials, low owner dependency, and a proven management team. A well-run sale process with competitive bidding can drive multiples significantly above what any internal buyer could afford.

But fathers need to count the full cost, not just the purchase price.

First, taxes. A third-party sale is almost always a taxable event. Depending on your entity structure, the split between asset sale and stock sale, your state of residence, and current capital gains rates, you may lose thirty to forty-five cents of every dollar to federal and state taxes. That seven-figure check shrinks fast.

Second, control. The moment the ink dries, you have no say in what happens to the company. The culture you built, the employees who trusted you, the customers who relied on your word. All of it belongs to someone else. I have watched private equity firms strip companies to the studs within a year. If your business serves your church or community in meaningful ways, that service dies with the sale unless the buyer shares your convictions. And they almost never do.

Third, legacy. Your sons do not inherit a business. They inherit cash, which is a fundamentally different thing. Cash can be invested wisely or squandered in a single generation. A business is a productive engine, a source of vocation, an anchor for a family in a specific place doing specific work. Selling to outsiders trades the engine for fuel. Fuel burns.

A third-party sale can be the right move when no internal successor exists, when the business requires capital or capabilities beyond the family's reach, or when the proceeds will be strategically deployed into other legacy-building assets. But it should never be the default. It should be the last resort of a man who has exhausted better options.

The Family Succession: The Patriarch's First Instinct, and His Hardest Work

Scripture is full of fathers passing the work to sons. Abraham to Isaac. David preparing Solomon to build the temple. The entire Levitical system organized around family lines performing specific functions across generations.

A family succession means transferring ownership and leadership to one or more of your children, usually over a period of years. This is the option that most naturally aligns with the biblical vision of multi-generational dominion. It keeps the business in the family, preserves the culture, maintains local presence, and gives your children a vocation with meaning, equity, and responsibility.

It is also the option that exposes every weakness in your family order.

If you have not trained your sons in the business, this will not work. If your children are not capable or willing, forcing them into leadership is a curse, not a blessing. If you have not structured the transfer properly with the right legal entities, buy-sell agreements funded by life insurance, and a clear governance framework, the whole thing collapses into sibling rivalry the moment you are gone.

The financial mechanics require serious planning. Gifting shares over time using annual exclusions and lifetime exemptions. Selling to a grantor trust to freeze the estate value. Using life insurance to equalize the inheritance between children who are active in the business and those who are not. Structuring an installment sale so the purchase is tax-efficient for both generations.

None of this happens on accident. It takes years of preparation, and it requires a father who is willing to have hard conversations with his children about calling, competence, and the difference between entitlement and earned authority.

When it works, there is nothing more powerful. A family business handed well from father to son carries forward not just economic value but vocational identity, community presence, cultural memory, and covenantal continuity. Your grandchildren grow up knowing who they are and what their family does. That is priceless.

The Management Buyout: Rewarding Faithful Servants

Not every man has sons who are called to the business. Some have daughters married to men with different vocations. Some have young children who will not be ready for decades. Some have no children at all.

In a management buyout, your existing leadership team purchases the company, usually with a combination of seller financing, bank debt, and sometimes outside equity. You effectively become the bank for a season, receiving payments over time rather than a lump sum.

The advantages for a patriarch are significant. The people who buy the business already know it. They love it. They have proven themselves faithful in managing what you built. The culture survives. The employees keep their jobs. The transition is smooth because nothing dramatic changes on the outside.

The disadvantages are equally real. Your management team rarely has the personal capital to pay full market value. The deal will almost certainly be smaller than a third-party sale. You carry significant risk as the financing source, because if they fail to run the business well, your payments stop. And you must be honest about whether your managers are truly capable of ownership or simply good at executing your vision under your authority.

From a stewardship perspective, a management buyout honors loyalty. Proverbs 27:18 says, "Whoever tends a fig tree will eat its fruit, and he who guards his master will be honored." If you have faithful managers who have helped build the enterprise, there is something deeply right about letting them reap the reward of their labor.

Structure it carefully. Seller notes with proper security interests. Life insurance on the key buyers so your family is protected if they die before paying off the note. Clear non-compete and transition agreements. And a realistic valuation that is fair to both sides, not inflated pride and not charitable underpricing.

The ESOP: Broad-Based Stewardship With Significant Tax Advantages

An Employee Stock Ownership Plan allows you to sell some or all of the business to a trust that holds shares on behalf of your employees. This is one of the most tax-advantaged exit strategies available, and it is criminally underused by Christian business owners.

Here is why it matters. If your company is a C corporation (or you convert to one), you can sell your shares to an ESOP and defer capital gains taxes indefinitely by reinvesting the proceeds into qualified replacement property. The company's contributions to the ESOP are tax-deductible. And if the ESOP eventually owns 100% of an S corporation, the company pays zero federal income tax.

Read that again. Zero federal income tax on the operating entity.

For a patriarch who cares about his employees, his community, and tax efficiency, an ESOP can be a remarkable tool. It rewards the people who built the business alongside you. It keeps the company local and intact. It creates a culture of ownership that drives performance. And it provides you with liquidity while preserving much of the enterprise's ongoing value.

The complexity is real. ESOPs require independent valuation, a trustee, ongoing compliance, and careful structuring. The costs are higher than a simple sale. And you lose some control over the company's direction once the ESOP is established.

But for the right business, particularly companies with strong cash flow, loyal employees, and an owner who values stewardship over maximum extraction, an ESOP is a tool that most advisors never even mention. I bring it up because most Christian men have never heard of it, and because it aligns beautifully with a vision of business that serves the common good rather than just the owner's bank account.

The Recapitalization: Taking Chips Off the Table While Staying in the Game

A recapitalization, often called a "recap," involves selling a majority or minority stake to a private equity firm or strategic partner while retaining meaningful ownership and continuing to run the business. This is increasingly common and deserves serious consideration.

The logic is simple. You convert a portion of your illiquid business equity into cash today, reducing your personal concentration risk. You gain a capital partner who can help accelerate growth. And you retain upside for a "second bite of the apple" when the company is sold again in five to seven years, often at a significantly higher valuation.

For a Christian father, the appeal is this: you diversify your family's wealth without abandoning the business. You still lead. You still set the culture. You still employ your people. But your family is no longer one bad quarter away from financial catastrophe because everything you own is locked inside a single illiquid asset.

The danger is equally clear. Private equity partners are not silent. They will impose financial targets, reporting requirements, governance structures, and strategic priorities that may conflict with your values. They are optimizing for a five-year exit, not a hundred-year legacy. If you cannot negotiate strong protections for culture, employees, and decision-making authority, you will find yourself a minority voice in your own company within two years.

A recap can be wise stewardship for the man who needs liquidity, wants to de-risk his family, but is not ready to walk away. It buys time. It funds trusts, pays off debt, and creates a financial cushion. But it is a partnership, and partnerships require alignment of values. Choose your partner with the same care you would choose an elder in your church.

The Liquidation: The Option Nobody Wants to Discuss

Some businesses cannot be sold. The value is entirely dependent on the owner. There are no transferable systems, no management team, no recurring revenue, no intellectual property. The business is the man, and when the man leaves, the business ceases to exist.

In liquidation, you sell the assets: equipment, inventory, real estate, customer lists, and whatever else has independent value. You collect what you can, pay off debts, and close the doors.

This is not inherently a failure. Some businesses are genuinely personal practices or consulting firms where the owner is the product. But it is a tragedy when it happens to a company that could have been transferable if the owner had started preparing five or ten years earlier.

Every assessment question in my framework about owner dependency, management independence, documented processes, and transferable customer relationships exists precisely to prevent this outcome. A business that depends entirely on you is not a business. It is a job that dies when you do.

If you are reading this and recognizing that your company might fall into this category, do not despair. Start building transferability now. You may have five, ten, or fifteen years to reshape the enterprise into something that can outlive you. But you must start.

The Question Behind Every Exit

Here is what I want you to see. The question is not merely "How do I get the most money?" That is the question the world trains you to ask. The question a patriarch asks is different.

"Which transition best positions my family, my employees, my church, and my community for the next hundred years?"

That question changes everything. It forces you to evaluate not just the purchase price but the tax impact, the cultural continuity, the vocational future of your children, the security of your employees, the ongoing support of your local church, and the long-term trajectory of the wealth.

A man who asks only about the check will take the highest offer and wonder five years later why everything fell apart. A man who asks the right question will sometimes take a lower price because the structure preserves something money cannot replace.

I have sat across the table from both kinds of men. The difference between them is not intelligence or business acumen. The difference is vision. One sees to the closing date. The other sees to his great-grandchildren.

Where Do You Start?

You start by knowing exactly where you stand. Not a guess. Not a hope. A clear-eyed, comprehensive assessment of your business readiness, your personal financial position, your estate coordination, your family alignment, and your spiritual vision for the wealth God has entrusted to you.

Christian Business Exit Planning Starts With Knowing Where You Stand

I built an assessment that covers all of it. Nearly two hundred questions on the personal side spanning financial planning, estate design, tax strategy, physical health, relational strength, and kingdom vision. Over a hundred and sixty on the business side covering financial performance, revenue quality, customer concentration, management depth, operational systems, legal compliance, and owner dependency.

Every question is designed to surface what you cannot see on your own. The fractures that will cost you hundreds of thousands or even millions at the negotiating table. The family conflicts that will erupt if left unaddressed. The structural gaps that limit which exit paths are even available to you.

Take the assessment. See the gaps. Then let me help you build the plan.

I will walk with you as your family legacy advisor, coordinating the attorneys, CPAs, insurance specialists, and real estate counsel you need. I will help you see the connections between your exit strategy, your estate plan, your insurance structures, your tax position, and your family vision. I will tell you the truth. And I will help you choose the path that does not just maximize a number but maximizes a legacy.

Your business belongs to God. Your family is His covenant gift. Your community is your field of labor. Steward all of it with the seriousness it deserves.

Let's Connect

If you've been sitting with questions like:

"Should I sell to the highest bidder, or is there a path that keeps this business in the family?"

"What happens to my employees, my culture, and my community if I hand this company to a private equity firm?"

"Do my sons have what it takes to lead this business, and have I done the work to prepare them?"

"Am I about to lose forty cents of every dollar to taxes because I never structured this properly?"

"Will my business outlive me, or does it die the day I stop showing up?"

Then let's talk.

Imagine ending 2026 with a clear understanding of which transition path actually serves your family, your church, and your community for generations. A succession strategy built around your specific business, your specific family, and your specific calling. Estate and entity structures coordinated with your exit so nothing falls through the cracks. Insurance and tax strategies that protect your wife, equalize the inheritance among your children, and keep the wealth working instead of hemorrhaging to the government.

That is what a patriarch's transition plan looks like. Not a rushed sale. Not a vague hope that the kids will figure it out. A deliberate, documented, God-honoring transfer of dominion from one generation to the next.

And you were never meant to navigate this alone. Fathers need counsel from men who understand both EBITDA multiples and biblical headship, who can walk with you through the complexity of business valuation, family dynamics, tax planning, and generational vision without losing sight of what actually matters.

The world tells you to cash out, diversify into index funds, and spend your last decades on a golf course. Scripture calls you to something far greater: a household that endures, sons trained for leadership, employees honored for their faithfulness, and great-grandchildren who inherit both substance and conviction.

Choose the harder path. Build legacies that last.

Schedule Your Free Exit Readiness Consultation Today

At Dominion Business Advisors, we help business owners like you build businesses that bless beyond the bottom line. Together, we’ll walk through where you are today, where you want to go, and what it takes to get there, so you can exit your business on your terms and leave a legacy that lasts.

Final Encouragement

Remember, you were never meant to do this alone. Let us walk alongside you in building a plan that brings clarity, confidence, and legacy for the next season of your life and leadership.

*Dominion Business Advisors LLC provides strategic business consulting and exit planning services. We do not provide legal, tax, or investment advice. Information in this article is for educational purposes only and should not be construed as specific advice for your situation. Please consult your attorney, CPA, and financial advisor before implementing any exit planning strategies.

.png)